Average Insurance Payout for Hail Damage Car Guide

Ever seen a hailstorm turn your car into a bumpy mess? You’re not alone. Hail damage can make driving stressful and costly, leaving car owners worried about insurance and payouts.

Every year, many car owners deal with hail damage. State Farm’s 2021 data shows an average payout of $5,000 for hail damage claims. This shows how much these storms can hurt your car’s value.

This guide will help you understand insurance payout for hail damage car . We’ll cover claim processes and how to get the most from your insurance. Our goal is to save you time, money, and stress.

Table of Contents

Understanding Hail Damage and Its Impact on Vehicles

Hail damage can hit without warning, leaving your car looking like it’s been hit by a hammer. Having vehicle hail damage insurance is key when bad weather threatens your car’s looks and safety.

Hailstorms can be very dangerous for cars, even small hailstones can cause big damage. Knowing about hail damage helps car owners keep their cars safe and deal with insurance claims better.

What is Hail Damage?

Hail damage happens when ice balls fall from the sky during thunderstorms. They can make dents, dings, and even harm your car’s structure. How bad it is depends on:

- Hailstone size (from pea-sized to softball-sized)

- Wind speed during the storm

- Impact angle of the hailstones

- Vehicle surface material and shape

Signs Your Car Has Hail Damage

Spotting hail damage early can help you get better repair estimates. Look for these signs:

- Dents on flat surfaces like the hood, roof, and trunk

- Chipped or cracked paint

- Broken or cracked windshield and windows

- Dimpled exterior panels

How Hail Damage Affects Vehicle Value

Not fixing hail damage can lower your car’s value a lot. Insurance adjusters and buyers will see even small flaws. Having full insurance coverage usually covers repair costs, keeping your car’s value up.

Prompt repair and documentation are key to maintaining your vehicle’s value after a hailstorm.

Using professional repair methods like Paintless Dent Repair (PDR) can fix your car’s looks without harming the paint. This helps keep your car’s value and looks good.

Average Insurance Payout for Hail Damage Car

When your car gets hit by hail, knowing how much insurance might pay can help. The rules for getting money back for car damage have changed a lot recently.

Recent data shows how much insurance pays for hail damage claims. From 2020 to 2021, the average payout went up a lot:

- 2020 average payout: $4,300

- 2021 average payout: $5,000

- Year-over-year increase: $700 (approximately 16.3%)

Key Factors Influencing Payout Amount

Several important things affect how much you might get for hail damage:

- How bad the damage is

- What your car is worth now

- What your insurance policy says

- How much you have to pay first (deductible)

Statistical Insights on Hail Damage Claims

Insurance companies like State Farm say that full coverage policies usually cover hail damage best. How much you get depends on the damage and your policy.

Remember: Making too many claims in a short time can raise your insurance costs.

Knowing these details can help you make smart choices about your insurance claim and compensation for hail damage.

Types of Insurance Coverage for Hail Damage

Protecting your vehicle from unexpected weather damage is key. You need to know about vehicle hail damage insurance coverage. Not all insurance policies are the same. Knowing the details can save you a lot of money and stress during hail season.

Comprehensive coverage is your main defense against hail damage. It’s different from collision insurance. It protects your car from natural disasters like hailstorms. The cost for this coverage is between $100 and $300 a year.

Comprehensive vs. Collision Coverage

It’s important to know the difference between these coverage types. This helps with the auto hail damage claims process. Here’s a quick comparison:

- Comprehensive Coverage:

- Covers damage from natural events

- Protects against hail, wind, and storm damage

- Typical deductibles range from $50 to $2,000

- Collision Coverage:

- Covers damage from vehicle accidents

- Does not protect against hail damage

- Typically more expensive

Importance of Having Hail Insurance

States like Texas, Nebraska, and Kansas get hit by hailstorms often. This makes having the right coverage important. State Farm says hail caused over $600 million in vehicle damage in 2022.

“Protecting your vehicle is not just about repair costs, but safeguarding your financial investment.”

Think about getting this coverage if:

- Your vehicle is worth more than $3,000

- Your car is less than 10 years old

- You live in a hail-prone region

The average insurance payout for hail damage is about $5,000. This makes getting the right coverage a smart choice for many drivers.

The Claims Process for Hail Damage

Understanding the auto hail damage claims process can be tough. But knowing the right steps can make it easier and more successful. Every year, about 245,000 personal auto insurance claims are filed for hail damage in the U.S.

Handling hail damaged vehicle insurance payouts needs a smart plan. Here are the key steps to manage your claim well:

- Contact Your Insurance Provider Immediately

- Report the damage within 24-48 hours

- Check if your coverage includes hail damage

- Document the Damage Comprehensively

- Take clear, well-lit photos from different angles

- Record the date and location of the hailstorm

- Capture close-up and wide-angle shots of damage

- Prepare for the Insurance Adjuster’s Assessment

- Schedule an inspection at your convenience

- Have all your documents ready

- Be there during the assessment

Pro Tip: Most policies cover hail damage, but deductibles vary. Always check your policy before filing a claim.

Remember, the key to a successful hail damage claim is thorough documentation and prompt communication with your insurance provider.

Repair times can be short or long, depending on the damage. Some insurance companies work with trusted auto body shops. This can speed up your claim.

Average Costs of Repairing Hail Damage

Hail damage can cause a lot of harm to your vehicle. It leaves dents and dings that affect how it looks and its value. Knowing the costs of fixing hail damage helps you understand the process of fixing your car.

The cost to fix hail damage can vary a lot. It depends on several important things. Car owners might have to pay anywhere from a few hundred to several thousand dollars.

Factors Affecting Repair Costs

Several things can change how much it costs to fix hail damage:

- Number and size of dents

- Vehicle make and model

- Panel material (steel vs. aluminum)

- Repair technique chosen

Detailed Repair Cost Breakdown

Here’s a look at typical costs for fixing hail damage:

- Small dent repair: $30-$45 per dent

- Medium dent repair: $45-$55 per dent

- Large dent repair: Over $75 per dent

- Paintless Dent Repair (PDR): $50-$200 per dent

- Full car respray: Up to $5,000

Fixing five small dents could cost about $225. Fixing ten large dents might cost around $1,000. On average, fixing all hail damage can cost between $3,000 and $8,000.

Comparing Repair Costs to Insurance Payouts

Your insurance coverage is key in handling hail damage repair costs. Most insurance covers these costs. Payouts usually range from $4,000 to $15,000, based on the damage.

Pro tip: Document every detail of hail damage for accurate insurance claims.

Remember, not fixing hail damage can lower your car’s resale value. Getting it fixed quickly is a smart choice.

Tips for Maximizing Your Insurance Payout

Handling an auto hail claim can be tough. Being well-prepared and documenting everything can boost your payouts. Knowing the claims process is key to getting the most from your insurance.

For a successful claim, follow a step-by-step plan. Here are some tips to help you get more money:

- Document damage thoroughly with high-quality photographs

- Capture multiple angles of hail-impacted areas

- Include timestamps on all documentation

- Obtain multiple repair estimates from certified technicians

Understanding Your Policy Limits

Your insurance policy is full of important details. It affects how much you can get for hail damage. Make sure to:

- Check your coverage specifics

- Know your deductible amounts

- Understand depreciation calculations

- Look for replacement value provisions

Preparing for the Adjuster’s Inspection

The adjuster’s visit is key to your payout. Being ready is essential. Collect all important documents, such as:

- Detailed repair estimates

- Photographic evidence

- Vehicle maintenance records

- Communication logs with insurance reps

Pro tip: Public adjusters can help secure settlements up to 800% higher than independent claims.

Studies show that well-documented claims can get up to 30% more money. By using these tips, you’ll be ready to get the best insurance payout for hail damage.

Common Misconceptions About Hail Damage Claims

Dealing with vehicle hail damage insurance can be confusing. Many car owners don’t understand how hail damage claims work. This can cause stress and confusion about their insurance.

Knowing the truth about hail damaged vehicle insurance payouts is key. It helps you make smart choices. Let’s look at some common myths that might affect your insurance claim.

Debunking Insurance Coverage Myths

- Myth: All hail damage is automatically covered

Reality: It depends on your policy. Most policies cover hail damage, but each is different.

- Myth: Filing a claim will always increase insurance rates

Studies show hail damage claims are usually no-fault. Most insurers won’t raise your rates for damage from weather.

- Myth: Minor dents aren’t worth reporting

Even small hail can cause big damage. Paintless Dent Repair (PDR) can fix minor dents quickly, often in hours.

What’s Typically Not Covered

Some policies have limits for hail damage. Common exclusions include:

- Damage that existed before the hailstorm

- Damage to parts not essential for the vehicle

- Cosmetic damage that doesn’t affect how the vehicle works

Always check your policy details to know what’s covered. Talking to your insurance agent can help clear up any confusion.

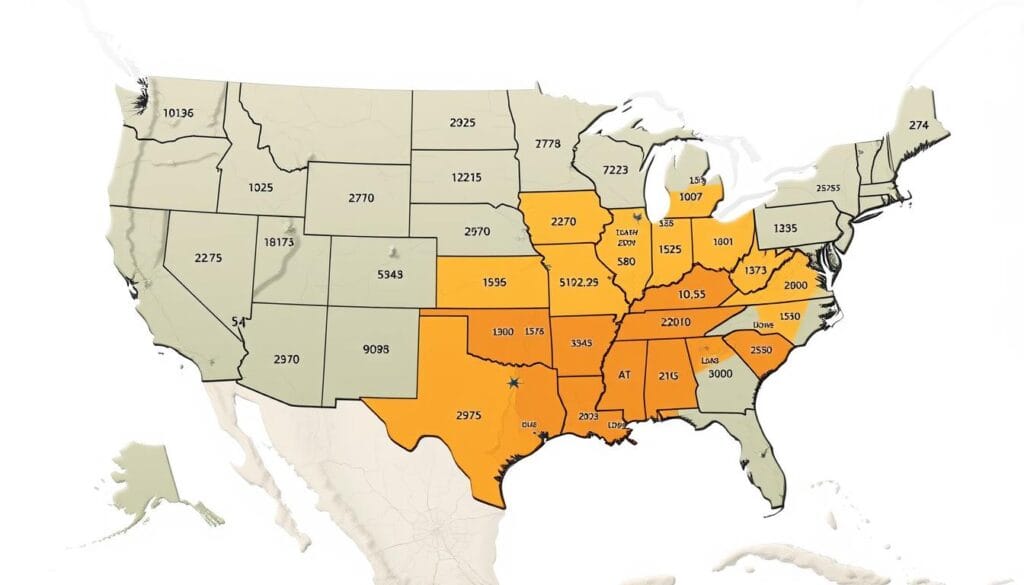

Regional Differences in Hail Damage Insurance Payouts

Knowing how hail damage insurance payouts change in different areas is key. The United States sees big differences in hail events and insurance coverage. This affects how much you might get for hail damage car claims.

Hail damage risks vary across the country. Some states face much more hail, which changes insurance rates and payouts.

State-by-State Hail Event Breakdown

- Texas reported 1,123 hail events in 2023, a big jump from 458 in 2022

- Nebraska had 486 hail events in 2023

- Kansas saw 459 hail events in 2023

- Colorado and Missouri each had 400 hail events

Insurance Coverage Variations

Your location greatly affects car hailstorm damage compensation. States with more hail often have more complex insurance policies. For example:

- South Dakota has 69% of drivers with full-coverage insurance

- Colorado keeps 61% full coverage

- Arkansas has only 49% of drivers fully insured

Financial Impact of Hail Damage

The financial effects of hail damage vary a lot. Texas sees an average of 124 hail events yearly, causing $338.6 million in property damage. Smaller states like Rhode Island have much less damage.

Understanding these regional differences helps you make better insurance choices. It also prepares you for hail damage risks in your area.

The Role of Insurance Adjusters in Hail Damage Claims

Insurance adjusters are key in handling auto hail damage claims. They figure out how much damage there is and what you might get paid for fixing it.

After a hail storm, an adjuster is your main person to talk to. They help you through the insurance claim process. Their main jobs are:

- Checking your car’s damage

- Recording how bad the hail is

- Figuring out repair costs

- Seeing if you’re covered

What to Expect During an Adjuster’s Inspection

The adjuster will look at your car’s damage closely. They check things like:

- How big and many hail dents are

- If there’s any damage to the car’s structure

- If paintless dent repair is needed

- The car’s overall condition

“Documentation is key in the auto hail damage claims process. The more evidence you provide, the smoother your claim will be.” – Insurance Claims Expert

Tips for Working with Adjusters

To get the most from your claim, follow these tips:

- Take clear, well-lit photos of all damage

- Get repair estimates from certified shops

- Be there when they first check your car

- Ask about what your policy covers

| Claim Aspect | Typical Adjuster Action |

|---|---|

| Initial Damage Assessment | Comprehensive visual inspection |

| Repair Cost Estimation | Detailed written estimate |

| Coverage Determination | Policy-specific evaluation |

Remember, a successful claim depends on clear communication and thorough documentation.

Preventing Hail Damage to Your Vehicle

Keeping your vehicle safe from hail damage is key to its value and avoiding high repair costs. Having vehicle hail damage insurance is helpful, but preventing damage is better. Knowing how to protect your car from hail can save you a lot of money.

- Find covered parking right away when storms are forecasted

- Invest in top-notch car covers made for hail protection

- Use portable car shelters or temporary carports

- Park in garages or under strong structures

Smart Protective Measures

Protecting your vehicle needs careful planning. Specialized car covers with padded layers offer vital protection against hailstones. Choose covers made to absorb impact and reduce dents.

Recommended Car Protection Options

| Protection Type | Cost Range | Effectiveness |

|---|---|---|

| Padded Car Covers | $50-$250 | High |

| Portable Car Shelters | $200-$800 | Medium-High |

| Permanent Garage Parking | Varies | Very High |

In areas prone to hail, investing in full protection is wise. Quick action during storm warnings can avoid expensive repairs. It also keeps your vehicle looking good and valuable.

Future Trends in Hail Damage Insurance

The world of auto hail claims is changing fast. This is because of more extreme weather and new tech. Hail-related claims went up from 9% in 2020 to 11.8% in 2022. Insurance companies are finding new ways to deal with the cost of severe weather damage.

New tech is making cars safer and insurance smarter. Electric vehicles and advanced repair methods are changing how claims are handled. Paintless dent repair (PDR) is now used for 80% of hail claims. It costs 159% more than old methods, showing a big change in how damage is fixed.

Insurance companies are getting ready for more extreme weather. In 2023, there were 28 billion-dollar weather events, up from 18 in 2022. This means they’re making coverage better for people in high-risk areas. Places like Texas and the Midwest are getting more attention.

As the weather keeps changing, you’ll see more tailored insurance. The future will bring advanced tech, better risk checks, and maybe cheaper insurance for cars with the latest safety features.